How $6.5 TRILLION Is Set To Hit The US After Election Day

Published 11/5/2024

Citadel CEO Ken Griffin recently highlighted during a panel discussion that while markets are currently uncertain, the conclusion of the presidential election will bring much-needed clarity, regardless of the outcome.

He stated, "Big picture, the reduction in uncertainty is almost always positive for asset prices. We're at that moment of peak uncertainty."

The current global economic landscape, marked by uncertainties and volatility, has led to a record $6.5 trillion in cash sitting on the sidelines, waiting for the right moment to be invested.

As these uncertainties begin to stabilize, this massive pool of capital is poised to flow into promising assets.

By the end of this article, we'll reveal a specific investment opportunity that we believe could benefit significantly from this incoming wave of capital.

But first, let's examine why the timing couldn't be better.

In the realm of technological advancements, few innovations have captured the imagination and potential for disruption like cryptocurrencies.

As of 2024, we've reached a critical milestone: approximately 6.9% of the global population, or about 560 million people, are invested in cryptocurrencies.

This is more than just a number. According to the Diffusion of Innovations Theory, developed by E.M. Rogers, the adoption of new technologies follows a predictable pattern.

Initially, a small group of innovators and early adopters embrace the innovation. Once adoption reaches around 5%, the innovation hits a tipping point, leading to rapid uptake by the early majority, followed by the late majority and laggards.

We have now crossed this critical 5% threshold.

The journey of cryptocurrencies from obscurity to mainstream acceptance has been nothing short of remarkable.

Bitcoin (BTC), the pioneer, was introduced in 2009, and for years, it remained a niche interest among tech enthusiasts and libertarians. However, as blockchain technology matured and the benefits of decentralized finance became evident, more people began to take notice.

The rise of Ethereum (ETH), with its smart contract capabilities, further expanded the possibilities of blockchain applications, attracting developers and businesses alike.

Today, cryptocurrencies are no longer just speculative assets; they are becoming integral to the global financial ecosystem.

Major corporations are integrating blockchain technology into their operations, and institutional investors are increasingly adding cryptocurrencies to their portfolios. This shift represents a fundamental change in how we perceive and interact with money.

The advantages of cryptocurrencies are manifold. They offer a hedge against inflation, provide access to decentralized financial services, and enable seamless cross-border transactions.

Moreover, the transparency and security of blockchain technology address many of the issues plaguing traditional financial systems.

Over the next 12 months, starting this week, we will be unveiling a plethora of cryptocurrency opportunities that we believe will perform exceptionally well.

You can anticipate potential gains of 2-3x from these upcoming recommendations, with detailed guidance on how to purchase these assets and our specific price targets.

However, due to the potential volatility leading up to the election day and possibly a few days thereafter, we are refraining from making any official recommendations at this time.

The possibility of black swan events in the coming days could impact both crypto and stock markets significantly. We prefer to avoid overexposure during such uncertain times.

With this in mind, we invite you to keep an eye on Hoppy (HOPPY) and Brett on Base (BRETT) with us over the coming days. Currently priced at $0.00025 and $0.078 respectively, we believe these tokens have the potential to perform exceptionally well in the near future.

Thank you so much for joining us on this investment journey.

We'll be diving deeper into more exciting topics in future newsletters.

If you've found this information valuable and want to stay updated on potential market-moving events and analysis, we invite you to subscribe to our free newsletter by clicking the link below:

By subscribing, you're not just getting stock/crypto tips - you're gaining insider access to the next big wave in investing.

We'll keep you ahead of the curve with in-depth analysis, industry insights, and timely updates on regulatory changes that could send stocks soaring.

Feel free to reach out anytime at info@AvidCapital.co

We personally read every message and your insights help shape our future discussions.

We’re looking forward to continuing this journey with you.

Until next time, stay curious and invest wisely!

Zack & Alex

DISCLAIMER:

By engaging with this email and all Avid Capital Partners content, you acknowledge and agree to the following terms. This is not financial advice. Conduct your own thorough research on all information provided. Avid Capital Partners is a publishing entity offering general information, opinions, and news coverage. We do not offer personalized financial advice and are not financial advisors. Our opinions may not be suitable for all investors and should not be interpreted as specific recommendations to make any particular investment or follow any specific strategy. Use this information at your own risk.

Past performance is not indicative of future results. Any results presented are not typical and should not be considered as such. Actual results can vary significantly due to factors such as experience, skill, risk management practices, market conditions, and the amount of capital invested.

Trading is inherently risky. Most traders in all markets lose money. Most small businesses fail. Do not engage in trading, investing, entrepreneurship, or any other risky endeavors discussed here unless you are fully prepared for the reality that most fail.

We reserve the right to maintain affiliate relationships with advertisers and sponsors.

It is important to note that this content is not paid promotional material. Avid Capital Partners has not received any compensation from the company/companies mentioned for the production or distribution of this information. Our goal is to provide unbiased, independent analysis and commentary based on our own research and insights.

In the interest of full disclosure, we want to inform our readers that Avid Capital Partners and/or its affiliates currently hold a position in the coin(s) mentioned in this content. Our investment in the stock does not influence our analysis or opinions, which are formed independently based on publicly available information and our own research methodologies.

6 Reasons This Tiny Biotech Could Surge Later This Month!

Published 9/18/2024

Welcome back savvy investors!

Today, we’re diving into an exciting opportunity in the healthcare sector that’s set to change lives and portfolios.

Imagine investing in a company that’s on the brink of revolutionizing the treatment for some of the most debilitating diseases known to man.

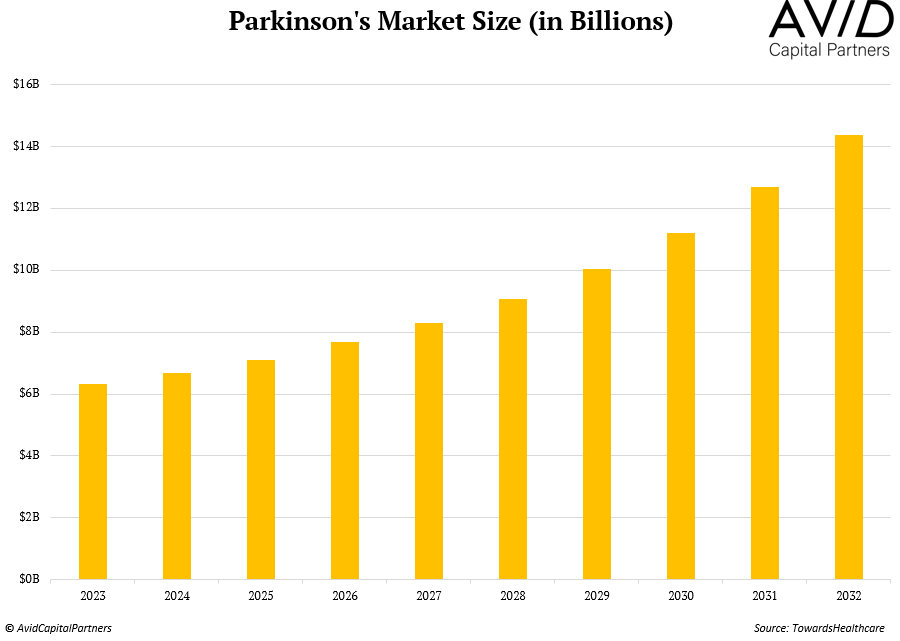

Parkinson’s disease, a neurodegenerative disorder affecting millions worldwide, is a significant and growing health challenge that desperately needs more effective treatments.

By 2032, the global market for Parkinson’s disease treatments is expected to soar to over $14 billion.

This growth is driven by an aging population and the urgent need for more effective therapies.

Now, what if I told you there’s a small biotech company that’s not only making waves in this space but is also poised for a major breakthrough announcement at the end of September?

Intrigued? You should be.

At the end of September, during the International Congress of Parkinson’s Disease and Movements Disorders event, a groundbreaking revelation is set to be unveiled.

This announcement could potentially change the landscape of Parkinson’s disease treatment.

This company has been working tirelessly on a novel approach that could significantly improve the lives of Parkinson’s patients.

The company I’m talking about is Gain Therapeutics (GANX).

Gain Therapeutics is a biotech firm that’s been flying under the radar, but not for long.

With a focus on developing treatments for neurodegenerative diseases, Gain is on the cusp of something monumental.

Here are 6 reasons we believe GANX could skyrocket soon:

1. Potential Cure for Parkinson’s:

Gain Therapeutics' drug GT-02287 may offer more than just treatment for Parkinson's - it might actually cure it.

How? It fixes a faulty enzyme that causes the disease. By doing this, it helps remove harmful proteins that damage brain cells.

Instead of just easing symptoms, GT-02287 could stop Parkinson's from getting worse in the first place. This means it might prevent the disease rather than just treat it.

And recent studies suggest Parkinson's disease begins developing up to ten years before symptoms appear. This discovery significantly expands the potential market for treatments, as patients may need to take medication for much longer periods, potentially for the rest of their lives.

2. World-Class Leadership:

Gain Therapeutics boasts a stellar management team led by Dr. Khalid Islam, who has a track record of successful exits, including the sale of Immunomedics to Gilead for $21 billion and Gentium to Jazz Pharmaceuticals for $1 billion.

This kind of leadership is invaluable in navigating the complex biotech landscape.

3. Recent Insider Buying:

Nothing speaks louder than insiders putting their money where their mouth is.

Recently, two board members, the CEO, and the Executive Chairman have all bought shares in Gain Therapeutics.

This insider buying is a strong vote of confidence in the company’s future prospects.

4. Proprietary Magellan AI Platform:

Gain Therapeutics leverages its proprietary Magellan AI platform to discover novel therapeutics.

This cutting-edge technology, developed in collaboration with Nvidia (NVDA), allows the company to screen trillions of compounds efficiently, targeting previously undruggable proteins.

This platform is a game-changer in drug discovery.

5. Upcoming Milestones:

Gain Therapeutics has several catalysts on the horizon. The late-breaking abstract presentation at the end of September is just the beginning.

Gain plans to deliver three new presentations at an upcoming NeuroScience conference, showcasing preclinical data that demonstrates GT-02287's potential in additional conditions such as Alzheimer's and Lewy Body Syndrome.

The company aims to commence clinical trials in Parkinson's patients by the end of the year, as part of an expanded Phase 1 trial in Australia.

And Gain is also planning an FDA meeting for Phase 2 trials in the US, which could further validate their approach and open the door to significant funding and partnerships.

6. Valuation and Potential Gains:

Gain Therapeutics is currently trading at a fraction of its potential value.

With a market cap below $40 million, the upside is enormous.

If GT-02287 gets FDA approval and the company reaches a $1 billion valuation, investors could see gains of over +2,400%.

Given the recent acquisitions in the biotech space, with companies being bought for north of $500 million, Gain Therapeutics is positioned perfectly for a similar trajectory.

Take Alpine Immune Sciences (ALPN), for instance, which was acquired by Vertex (VRTX) in April 2024 for a whopping $4.9 billion. Or consider Morphic Holding (MORF), snapped up by Eli Lilly (LLY) in July 2024 for $3.2 billion.

These examples show the enormous potential for value creation in the biotech sector, especially for companies with promising drug candidates like Gain Therapeutics.

But here's where things get really exciting. GT-02287 isn't just targeting one disease - it's got its sights set on a whole range of neurodegenerative heavy-hitters.

We're talking Parkinson's, Gaucher Disease, Dementia with Lewy Bodies, and even Alzheimer's.

This isn't just a one-trick pony - it's a potential game-changer across multiple billion-dollar markets.

Let's put this in perspective: the total addressable market (TAM) for GT-02287 across these diseases is mind-boggling.

We're looking at patient populations ranging from thousands to millions in the US alone, with market potentials stretching from $1.2 billion for Gaucher Disease all the way up to a staggering $58 billion for Alzheimer's.

All told, we're talking about a combined market opportunity that could exceed $80 billion.

That's the kind of potential that turns tiny biotechs into industry titans, and savvy investors into very happy campers.

Now it’s important to state that investing in biotech can be risky, but the potential rewards are immense.

Gain Therapeutics is a company that’s not only addressing massive market needs but is also led by a world-class team with a proven track record.

With upcoming catalysts, including a major announcement at the end of the month, now is the perfect time to consider adding GANX to your portfolio.

Remember, the biotech sector is all about innovation and timing. Gain Therapeutics has both in spades.

Don’t miss out on this opportunity to invest in a company that could be on the verge of a major breakthrough in Parkinson’s disease treatment.

HOW WE’RE POSITIONING OURSELVES

Let’s consider $1,000 as our standard ‘full position’.

When we suggest a ‘starter position’, we’re talking about $250, or a quarter of a full position.

For GANX, we’re not advising a full position right now.

However, we want to ensure we have some exposure to capture potential future gains.

So, for the time being, we recommend initiating a half position in GANX immediately at $1.50/share or below.

Next, we’ll set Limit and Stop Buy orders to buy the dip should the price go lower and ride the momentum upwards before the stock fills its gap and surges higher.

Thank you so much for continuing with us on this investment journey.

We'll be diving deeper into more exciting topics in future newsletters.

If you've found this information valuable and want to stay updated on potential market-moving events and analysis, we invite you to subscribe to our free newsletter by clicking the link below:

By subscribing, you're not just getting stock tips - you're gaining insider access to the next big wave in investing.

We'll keep you ahead of the curve with in-depth analysis, industry insights, and timely updates on catalysts that could send stocks soaring.

Feel free to reach out anytime at info@AvidCapital.co

We personally read every message and your insights help shape our future discussions.

We’re looking forward to continuing this journey with you.

Until next time, stay curious and invest wisely!

Zack & Alex

DISCLAIMER:

By engaging with this email and all Avid Capital Partners content, you acknowledge and agree to the following terms. This is not financial advice. Conduct your own thorough research on all information provided. Avid Capital Partners is a publishing entity offering general information, opinions, and news coverage. We do not offer personalized financial advice and are not financial advisors. Our opinions may not be suitable for all investors and should not be interpreted as specific recommendations to make any particular investment or follow any specific strategy. Use this information at your own risk.

Past performance is not indicative of future results. Any results presented are not typical and should not be considered as such. Actual results can vary significantly due to factors such as experience, skill, risk management practices, market conditions, and the amount of capital invested.

Trading is inherently risky. Most traders in all markets lose money. Most small businesses fail. Do not engage in trading, investing, entrepreneurship, or any other risky endeavors discussed here unless you are fully prepared for the reality that most fail.

We reserve the right to maintain affiliate relationships with advertisers and sponsors.

It is important to note that this content is not paid promotional material. Avid Capital Partners has not received any compensation from the company/companies mentioned for the production or distribution of this information. Our goal is to provide unbiased, independent analysis and commentary based on our own research and insights.

In the interest of full disclosure, we want to inform our readers that Avid Capital Partners and/or its affiliates currently hold a position in the stock(s) mentioned in this content. Our investment in the stock does not influence our analysis or opinions, which are formed independently based on publicly available information and our own research methodologies.

It is crucial to understand that investing in financial markets carries inherent risks, including the potential loss of part or all of your invested capital. The value of investments can fluctuate significantly, and there is no guarantee of profits.

While we may hold positions in certain stocks, we reserve the right to sell our shares at any time without notice. Our decision to buy, hold, or sell any security is subject to change based on market conditions, new information, or other factors.

Always remember that your investment decisions should be based on your own research, financial situation, risk tolerance, and investment goals. We strongly recommend consulting with a qualified financial advisor before making any investment decisions.

December 2nd Surprise: The $444 Billion Opportunity You Can't Afford to Miss

Published 9/6/2024

Welcome aboard, savvy investors!

Get ready for some groundbreaking opportunities that could revolutionize your portfolio.

Today, we're diving into a sector that's on the cusp of explosive growth - one that's been simmering under the surface, waiting for its moment to shine.

Imagine an industry poised to disrupt multiple markets simultaneously - from healthcare to consumer goods, and even agriculture. We're talking about a potential goldmine that's been largely untapped due to outdated regulations.

But the winds of change are blowing, and smart investors who position themselves now could reap enormous rewards.

Let's talk numbers.

According to Fortune Business Insights, this burgeoning market is projected to reach a staggering $444 billion by 2030, with a compound annual growth rate (CAGR) of 34%.

That's the kind of growth that turns heads on Wall Street.

And here's the kicker - we could see a major catalyst as soon as December 2nd.

With elections around the corner, there's a real possibility of sweeping changes that could send this sector into overdrive. It's a hot-button issue that's gaining traction across the political spectrum.

Mark your calendars for December 2nd, because that's when the Drug Enforcement Administration (DEA) is set to hold a pivotal hearing that could reshape the entire landscape of this industry.

The DEA will be considering expert opinions on the Justice Department's proposal to federally reschedule marijuana from Schedule I to Schedule III under the Controlled Substances Act.

This isn't just bureaucratic shuffling - it's a seismic shift that could unlock massive potential for businesses in this space.

Why is this so important? Rescheduling would remove significant research barriers and potentially allow state-licensed cannabis businesses to take federal tax deductions under the IRS code known as 280E.

While it wouldn't fully legalize marijuana at the federal level, it would be the most substantial reform in over 50 years.

The hearing adds some uncertainty to the timeline, but it also signals that we're on the cusp of a major policy shift.

This is why we’re rushing to share with you these two cannabis stocks:

Canopy Growth (CGC)

This isn't just another player in the field - it's a titan in the making.

Back in 2018, Canopy was the darling of Wall Street, boasting a market cap of $17 billion or nearly $600 per share post-split.

Fast forward to today, and we're looking at a market cap of just $500 million. Now, before you run for the hills, hear me out.

This isn't a story of failure; it's a setup for an epic turnaround.

Our conservative price target of $50 per share would represent a 10x return from today's price. And get this - even at that level, we'd still be 90% below Canopy's peak valuation.

We're talking about a potential 10-to-1 risk-reward ratio. In my book, that's the kind of asymmetric bet that can supercharge a portfolio.

With strategic partnerships already in place, Canopy is perfectly positioned to capitalize on the inevitable merger of recreational and mainstream markets.

Their product pipeline is robust, spanning medical applications, recreational use, and even pet care.

Canopy's management team is another key factor in our bullish outlook.

Led by industry veterans, they've demonstrated a knack for strategic acquisitions and partnerships that have expanded their footprint globally.

As international markets open up, Canopy is primed to leverage its first-mover advantage.

Their recent moves in the European market, particularly in Germany, could prove to be a masterstroke as the continent inches towards more progressive policies.

But perhaps most exciting is Canopy's focus on innovation.

They're not just waiting for legalization - they're actively shaping the future of the industry.

From developing new strains to exploring novel delivery methods, Canopy is laying the groundwork to dominate multiple segments of this emerging market.

When the floodgates open, they'll be miles ahead of the competition.

Moving on to our second pick:

Aurora Cannabis (ACB)

Let me tell you, this company is a dark horse ready to burst out of the gates.

While it’s flown under the radar of many investors, those in the know recognize Aurora's potential to become a global powerhouse.

Now, here's where things get really interesting. Just like Canopy, Aurora’s market cap peaked at $9 billion back in 2018, or a jaw-dropping $1,500 per share post-split.

Fast forward to today, and we're looking at a market cap of just $300 million.

But here's the kicker: Aurora is cash flow positive and fundamentally strong. That's right, while others are burning through cash, Aurora's already turning a profit.

Now, our conservative price target - and I mean conservative - of $60 per share would represent a 10x return from today's price.

Even at that level, we'd still be 95% below Aurora's peak valuation. That’s another potential 10-to-1 risk-reward ratio.

That being said, their production capacity is second to none, with state-of-the-art facilities that can churn out premium products at scale. This gives them a crucial edge in what will undoubtedly become a price-competitive market.

What truly sets Aurora apart is their laser focus on medical applications.

While others are scrambling for recreational market share, Aurora has been quietly building a moat in the medical field.

They're not just selling a product; they're pioneering treatments that could transform lives.

With ongoing clinical trials and a growing body of research, Aurora is positioning itself at the forefront of a medical revolution.

When mainstream acceptance hits, they'll have the credibility and infrastructure to dominate this high-margin segment.

Don't overlook Aurora's international strategy, either.

They've cast a wide net, establishing footholds in key markets across Europe, South America, and Australia.

This global diversification not only spreads risk but also ensures Aurora can capitalize on regulatory changes wherever they occur first.

As dominos start to fall around the world, Aurora will be uniquely positioned to serve emerging markets with locally produced, high-quality products.

HOW WE’RE POSITIONING OURSELVES

Let’s consider $1,000 as our standard ‘full position’.

When we suggest a ‘starter position’, we’re talking about $250, or a quarter of a full position.

For CGC and ACB, we’re not advising a full position right now.

However, we want to ensure we have some exposure to capture potential future gains.

So, for the time being, we recommend initiating a starter position in CGC immediately at $4.51/share and ACB at $5.36/share.

Next, we’ll set Limit and Stop Buy orders to buy the dip should the price go lower and ride the momentum upwards before these stocks break out to new 52-week highs in the coming months.

Thank you so much for joining us on this investment journey.

We'll be diving deeper into more exciting topics in future newsletters.

If you've found this information valuable and want to stay updated on potential market-moving events and analysis, we invite you to subscribe to our free newsletter by clicking the link below:

By subscribing, you're not just getting stock tips - you're gaining insider access to the next big wave in investing.

We'll keep you ahead of the curve with in-depth analysis, industry insights, and timely updates on regulatory changes that could send stocks soaring.

Feel free to reach out anytime at info@AvidCapital.co

We personally read every message and your insights help shape our future discussions.

We’re looking forward to continuing this journey with you.

Until next time, stay curious and invest wisely!

Zack & Alex

DISCLAIMER:

By engaging with this email and all Avid Capital Partners content, you acknowledge and agree to the following terms. This is not financial advice. Conduct your own thorough research on all information provided. Avid Capital Partners is a publishing entity offering general information, opinions, and news coverage. We do not offer personalized financial advice and are not financial advisors. Our opinions may not be suitable for all investors and should not be interpreted as specific recommendations to make any particular investment or follow any specific strategy. Use this information at your own risk.

Past performance is not indicative of future results. Any results presented are not typical and should not be considered as such. Actual results can vary significantly due to factors such as experience, skill, risk management practices, market conditions, and the amount of capital invested.

Trading is inherently risky. Most traders in all markets lose money. Most small businesses fail. Do not engage in trading, investing, entrepreneurship, or any other risky endeavors discussed here unless you are fully prepared for the reality that most fail.

We reserve the right to maintain affiliate relationships with advertisers and sponsors.

It is important to note that this content is not paid promotional material. Avid Capital Partners has not received any compensation from the company/companies mentioned for the production or distribution of this information. Our goal is to provide unbiased, independent analysis and commentary based on our own research and insights.

In the interest of full disclosure, we want to inform our readers that Avid Capital Partners and/or its affiliates currently hold a position in the stock(s) mentioned in this content. Our investment in the stock does not influence our analysis or opinions, which are formed independently based on publicly available information and our own research methodologies.

It is crucial to understand that investing in financial markets carries inherent risks, including the potential loss of part or all of your invested capital. The value of investments can fluctuate significantly, and there is no guarantee of profits.

While we may hold positions in certain stocks, we reserve the right to sell our shares at any time without notice. Our decision to buy, hold, or sell any security is subject to change based on market conditions, new information, or other factors.

Always remember that your investment decisions should be based on your own research, financial situation, risk tolerance, and investment goals. We strongly recommend consulting with a qualified financial advisor before making any investment decisions.